Reflections

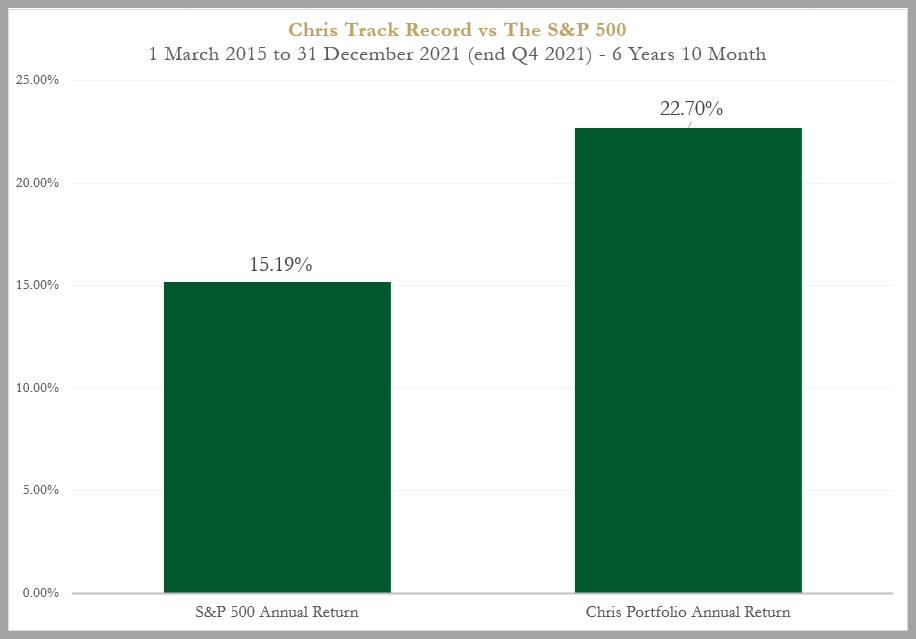

22.70% vs 15.19%; My Performance vs S&P 500 for Close to 7 Years

2 January 2022

In this article, I am going to try to condense what I have reflected on, learned, and applied throughout the year 2021 and in my past close to 7 years of investment experience.

Since this is an investment blog, we are going to start with my annualized return taking into account the time of, and deposits and withdrawals. It currently stands at 22.70% which beats the S&P 500 return of 15.19%. I am satisfied as it is in line with my long-term goal of achieving a minimum of 20% a year for – 40, 50 years to come.

It is calculated using XIRR – which stands for the individual rate of return or our real investment return.

While calculation using IRR does not take into account the actual cash flow that takes place, XIRR considers the dates when the cash flow actually happens. Thus, XIRR is more accurate to calculate annualized returns.

A lot of my investment success has been found in going against contrary beliefs and proven to be right over time.

Here are some of the guiding principles that I understood:

1. “What is the dumb thing I could do here and how can I avoid it?” – it is the wisdom of simply not trying to do stupid things.

2. “Is the price mouthwatering enough to buy and to sell?” – it is focusing on truly going for the action that contains a lot of convictions, instead of engaging in frequent buying and selling.

3. First and foremost, I love investing in high-quality businesses that I understand and people often misunderstood.

4. Businesses that can compound their earnings rapidly are the type of business I love to hold over a long time horizon.

5. The trick for my portfolio management is simply they have to reflect my best vision of the future. And I manage it that way.

6. Having in mind that the best opportunities for multi-baggers usually come in companies that are relatively unknown or under the radar, smaller companies, with unique products or services that have large TAM coupled with management with good track records of strong execution and innovation.

7. I usually invest in around 10-15 positions with my top 3 holdings usually consisting of about 15-20% allocation each. All of those companies tend to have a strong and most importantly, durable competitive advantage.

8. I do not invest as much in companies that are still in the experimentation stage. I prefer companies that already have a product-market fit and are in the scaling stage.

9. Long-term tailwinds are always positive coupled with a possible inflection point through a short-term trend specific to the company.

10. I love simple and predictable businesses that have a strong consumer appeal.

11. But ultimately, the most important edge as an investor in my view is our mental strength and discipline in being rational enough in not overpaying and in not selling too soon. When there is nothing to do, the best thing to do is to do nothing.

12. All that we can control in investing is simply this: the risk we take.

13. Remember always: the market does not know that we own the stock, the market does not know us personally, we cannot control the market movements and all we can do is make the best decision we can rationally at the point in time.

14. And beware of our psychological biases such as hindsight and anchoring bias. As well as the “Halo effect” — where we think that the company we already own are naturally the best and we cannot think of bad things about them.

15. Never stop learning, always stay open-minded and never stop growing. Investment is after all, a lifelong practice of learning and growing.

This leads me to my next section of the article which is talking more about life outside of investments.

With any reflections, it is apt to start with asking the key question: what do we want out of life?

For me, at least three things: 1. Happy family 2. Enough wealth and 3. Enlightenment.

A happy family is one of the three points of what I want out of life. Why else do we work hard and grow, if it is not for our family? With our family, we can struggle and live meaningfully.

Source: Ray Dalio Facebook

Ray Dalio recently penned out a short but wise new year message in his Facebook post.

In life, giving and accepting love is nurturing for the giver and receiver.

Loving the life we have while having the passionate desire and power to pursue things that will fulfill us is important. And that comes from accepting not having things that are beyond our current ability to have.

In the middle of 2021, inspired by Ray, I paid more than $1,000 to learn how to do Transcendental Meditation (TM) from a licensed teacher. And I have been doing it regularly (20 minutes, 2 times daily) ever since.

TM has helped me a lot in terms of rewiring how my brain functions as it was able to train my brain’s ability to see things through a clearer lens. So that I am aware when I am caught in unimportant things. But more importantly, it has helped me to have more equanimity no matter what happens in life.

Being present allows us to be aligned in our body and mind. And that is an important character of enlightenment.

Only when we are present, we can be aware of things we need to let go of.

This is so that can achieve “ease” in life.

Meditation like TM is the easiest way to build the muscle and nervous system to increase patience and tolerance, reduce negative emotions as well as manage and reduce stress. It may also help to improve our relationships with others as we began to manage ourselves better.

Exercise is also an important part of my life today. The key is to be consistent and have a strong mind to still exercise even though I may feel lazy. I usually do slow jog, yoga, or swimming. I use Oura Ring to help to track my sleep quality (resting heart rate, total sleep time, etc), readiness, and calories burnt. My Garmin Forerunner 245 helps to track my running and swimming distance as it is more accurate and more suitable to do so with its GPS capabilities.

Exercise not only helps us to maintain our weight, but it is also beneficial to help keep our thinking, learning, and judgment skills sharp as we age. Not to mention it is also good for our mood and mental health.

In summary, I will keep it short for this year’s reflection to share that while wealth and annualized rate of return may be the KPI we look at in investment, there is more to life than money.

As Ray says, the wise know to savor the amazing things we already have and truly love the life we already have — while we work hard for things currently still beyond our ability to have.

Disclaimer:

The information provided is for educational and general information purposes only and is not intended to be personalized investment or financial advice. We make no promises as to the accuracy or usefulness of the information we present.

Important: Please read our full disclaimer.

Enjoyed the article?

Share it with your friends. Thank you!

Chris Lee Susanto

Full-time investor, speaker, and editor of the investment blog Re-ThinkWealth.com.

Chris started investing in stocks early at age 21 and is a big proponent of business-like stock investing – a mixture of both value and growth investing. He invests in companies where there is value to be found (as long as it is still within his circle of competence), be it a turnaround, depressed, value, or quality growth company (compounders). He either buys the stock outright or he profits through selling put or selling call options – or buying call options (buying and selling options are especially dangerous for those who do not know how to properly execute it).

Some of the places where Chris has been invited to speak or have added value as a mentor or writer includes Singapore Polytechnic, SMU Institute of Innovation and Entrepreneurship (IIE), Dollars and Sense, The New Savvy, Value Walk Blog, Investment Moats, NUS Tembusu College, NUS Investment Society, CGS-CIMB Singapore, Singapore Financial Conference by NTU IIC, The Financial Coconut Podcast, Money FM 89.3 and Internationally in Myanmar.

He is also a practitioner of Transcendental Meditation and Mindfulness practice. He also advocates regular exercise, enough sleep, and nutritious food as part of our lifestyle as an investor so that we can see things with a clearer lens and not be “caught” in the unimportant things.

As of the time of this writing, Chris is focusing on setting up his MAS Licensed Fund with the goal to beat the market over the long run.

Feel free to join his FREE investment telegram channel here to be one of the first to be updated on his new articles.

Don’t Leave First, Read Also:

Finding True Wealth: Achieving Peace of Mind and Balance in Life

Tony Robbins says that the quality of your life is directly proportional to the amount of uncertainty you can comfortably live with. The key is …

Mastering Risk vs. Return in Investing | Re-ThinkWealth

Risk and return are two of the most important concepts in investing. The relationship between these two factors is crucial to understanding […]

Here are the key principles of value investing | Re-ThinkWealth

The first value investing principle focuses on a company’s intrinsic value. This means looking beyond its market price and considering its […]

Understanding the Margin of Safety in Value Investing

One of the key concepts of value investing is the margin of safety, which is used to potentially reduce the risk of loss in investing in case of…

The Warren Buffett Approach to Value Investing

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

8 Tips on Life and Investment from Charlie Munger

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Definition and Important Good Characteristics of Value Stocks

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Ultimate List of Investing Resources in Singapore (Updated 2022)

Being an avid follower of many investments and finance blogs/websites/resources in Singapore, I thought, why not create an article sharing the…

Here Are 3 Powerful Lessons Investors Can Adopt from Roger Federer

“There is no way around the hard work. Embrace it.” – Roger Federer. In investment, it is important to continue “turning the stones” or keep finding […]

What is Truth Social, Mr. Trump’s Social Media Company?

Truth Social was launched in February 2022. More than one year after Donald Trump was banned from most social media platforms.

The Three US Stocks That Big Funds Are Buying: Booking, Alphabet & Microsoft

The three US stocks that the big fund managers are buying includes Booking Holdings Inc, Alphabet Inc and Microsoft Corp.

Rebranding of VIM logo to communicate our Values better

VIM/Value Investing Mentorship is an investment education […]