Welcome to The Re-ThinkWealth Blog

“The key to investing is not how smart we are or how fast we go. It is to be right more often than we are wrong. Big money is made swinging big for the fat pitches. It is going for the big bet right inside our competence circle. That’s the key to investing.” – Chris Susanto

About Chris Susanto

Chris is the Founder of Re-ThinkWealth.com & VIM (Value Investing Mentorship Club®).

He is also a Board Member at Bansea and an Independent Director of Bansea Fund 2. Bansea is Asia’s oldest angel investment network, founded in 2001.

Chris started investing in stocks early at age 21 and is a big proponent of business-like stock investing – a mixture of value and growth investing.

He invests in listed companies where there is value to be found (as long as it is still within his circle of competence), be it a turnaround, depressed, value, or quality growth company (compounders).

Some of the places where Chris has been invited to speak or have added value as a mentor or writer include Singapore Polytechnic, SMU Institute of Innovation and Entrepreneurship (IIE), Seedly TV, Dollars and Sense, The New Savvy, Value Walk Blog, Investment Moats, NUS Tembusu College, NUS Investment Society, CGS-CIMB Singapore, Singapore Financial Conference by NTU IIC, The Financial Coconut Podcast, Money FM 89.3 and Internationally in Myanmar. He is also a part of the SMU BFI (Business Families Institute) network.

Chris is also a practitioner of Transcendental Meditation.

“Meditation, more than any other factor, has been the reason for what success I’ve had. Meditation leads to openness, to freedom, where a kind of intuition just comes through. You could step back and put things in perspective” – Ray Dalio on Transcendental Meditation, founder of the largest hedge fund in the world with $140 Billion under management.

If you are also on LinkedIn, feel free to connect with Chris on Linkedin here and say hi!

Read Chris’s Latest Blog Post Now:

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

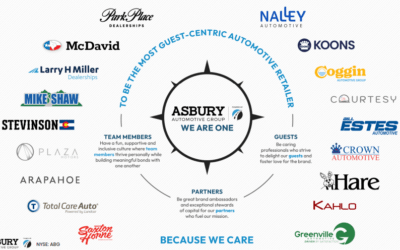

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …

Finding True Wealth: Achieving Peace of Mind and Balance in Life

Tony Robbins says that the quality of your life is directly proportional to the amount of uncertainty you can comfortably live with. The key is …

Mastering Risk vs. Return in Investing | Re-ThinkWealth

Risk and return are two of the most important concepts in investing. The relationship between these two factors is crucial to understanding […]

Here are the key principles of value investing | Re-ThinkWealth

The first value investing principle focuses on a company’s intrinsic value. This means looking beyond its market price and considering its […]

Understanding the Margin of Safety in Value Investing

One of the key concepts of value investing is the margin of safety, which is used to potentially reduce the risk of loss in investing in case of…

The Warren Buffett Approach to Value Investing

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

8 Tips on Life and Investment from Charlie Munger

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

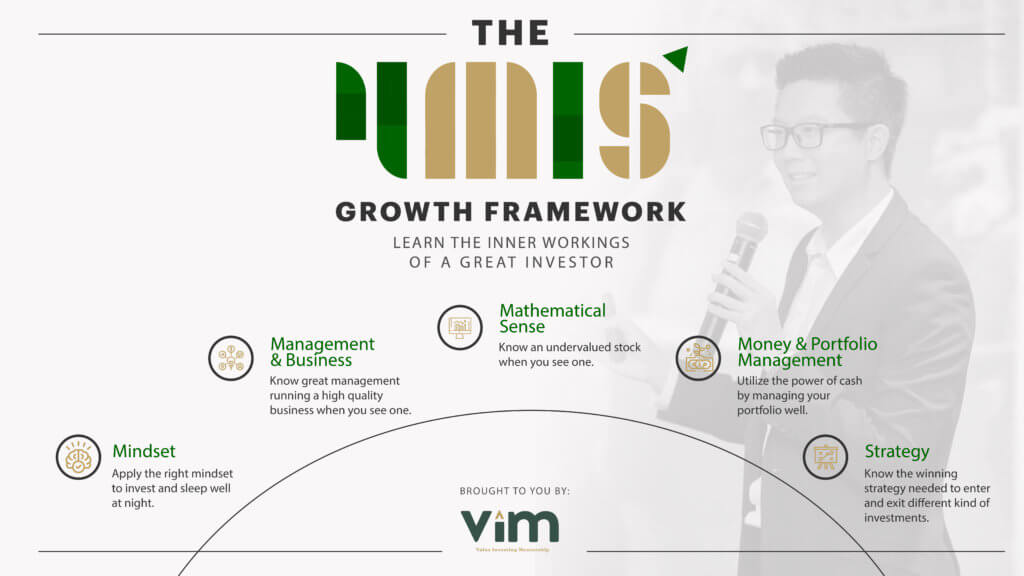

Unique 4M1S Framework

I created the 4M1S framework through my years of experience investing in the stock market since I was 21 – utilizing both stocks and options (buy and sell).

The framework is created mainly through my personal experience of what works and what does not work in the stock market.

More Testimonials on Chris

“Despite having >15yrs stock invest experience, I needed 1:1 guidance to stay focused in order to learn more about value investing. Chris’s newsletters and his personalized training can be of great help to beginners & matured investors.” – Ravi, Quality Manager from Leading US Semiconductor MNC

“Chris’s Exclusive 1:1 Mentorship has changed my life financially for the better. So far I have made over 20% in just 1 stock that I invested in. The profit that I got easily covered multiple times the fees I invested in the club. He is a passionate value investor and it is evident in the work that he put in for his members.” – Jess Liu, Executive Director, DBS Private Banking

“Chris Lee’s maturity beyond years coupled with service mindset drives his ideas to market. Re-Think Wealth is an open, accessible platform for anyone interested to learn and go live in the world of investing within a short period of time. Hard earned lessons from a wise peer mentor. Chris does not hold back to share.” – Liyana Sulaiman, CPO & Co-founder @ Pollen l Community Commerce Builder

“As part of my journey to learn about value investing, I came across Chris’s profile and joined his program to learn about options trading. Chris gave a step by step guidance and answered all my questions to give me the confidence to enter my first trade. His teaching of value investing and options trading is grounded with case studies and live teaching. I would recommend Chris and his VIM program for those looking for that edge.” – Russell N, Real Estate Fund Manager

“Great guy. Mature for his age and Good Insights. Would Recommend that People Subscribe to His Newsletter – useful!” – Kevin Lim, Associate Director – Portfolio, Strategy and Risk Group at Temasek Holdings

“I’ve been very impressed with Chris as someone who sets goals for himself and works hard to realize each of them. In particular, he’s impressed me with his knowledge of the finance world – particularly Value Investing and Options Selling – and I have found his Investing Newsletter to be Very Informative. He’s also a genuinely pleasant and gracious person – and very grounded – someone I enjoy talking with whenever the opportunity arises. I’m excited to see where life is going to take Chris – what opportunities will come his way – I believe his level of initiative is going to take him far.”- Tom Estad, Ex Academic Director, SUTD-SMU Dual Degree Programme at Singapore Management University