Summaries

A List of Value Investing Funds in Singapore and Outside of Singapore

Chris Lee Susanto, Founder at Re-ThinkWealth.com

14 July 2020 (Information in the article is as of May 2019)

As a value investor, as a practitioner of value investing, I am very interested in studying funds I view as an executioner of the various value investing methodologies I myself am very passionate about.

In this article, I will list down some of the value investing funds in Singapore and outside of Singapore.

All the information gathered is inferred from the fund’s respective websites. We make no warranty of any kind of the accuracy of the information provided, for further details best to check directly with them through their website. And this is not a sponsored post.

This list will be updated in the future.

My Thoughts on Running A Value Investing Fund

My end goal is to set up a sustainable and successful value equity fund for the long-term.

Although I have not set up my value investing fund, I have some friends who are either running their own funds or is an investment manager inside a value investing fund before.

How I Will Structure This Article

I will structure this article by first categorizing the various funds according to where they are mainly operating at. In this article, we will cover funds operating in Singapore and outside of Singapore.

I will list down the funds under each country according to these further subcategory:

A. Value proposition & fees – what is attractive in my view about these funds that makes investors want to invest in it. Fees to me are also a primary investor’s concern in today’s day and age. That is why I categorized value proposition and fees together.

B. Investment strategy – My summary of their investment strategy that they employ based on what I can deduce from their website.

C. Track records – their investment performance as listed on their website or other sources that I find credible.

Value Investing Funds in Singapore

1. Aggregate Asset Management

A. Value proposition & fees

- Zero management fee.

- A performance fee of 20% based on high water-mark which is used for salaries, director’s fees, office rental, marketing expenses, investment research, and beer and chips.

- $2000 one-time subscription charge for new clients.

- Fund expense ratio for custodian, admin and audit fees of approximately 0.13% of fund size.

- Aggregate said that they are the first fund management company in Singapore that offers a zero-management fee model in it’s one and only flagship fund – The Aggregate Value Fund.

- Aggregate say that typically most funds charge a management fee as a fixed percentage of assets under management (AUM). This incentive funds to chase for AUM instead of fund performance.

B. Investment strategy

- Value Investing.

- They invest in undervalued listed securities in Asia by practicing an independent, bottom-up approach to security selection.

- Extensive diversification across Asia – they hold more than 600 stocks in their portfolio. This results in low volatility and reduces the chances of substantial permanent loss.

C. Track records

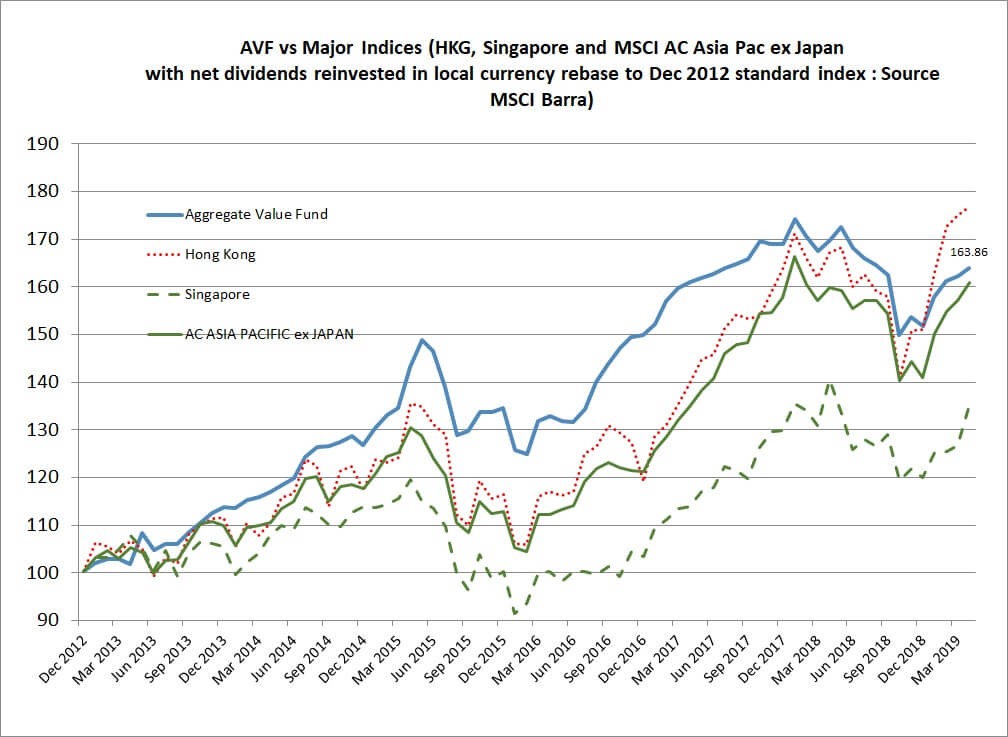

As of March 2019 since inception, Aggregate has beaten Singapore and AC Asian Pacific Ex Japan index but lose to Hong Kong index.

Their fund had done pretty well since inception.

Their outperformance is 0.38% against AC Asia Pac Ex Japan and 0.40% against the weighted index and this I assume is before fees.

Because there is no indication of whether the performance is net of fees or not.

Source: Aggregate Asset Management

2. Yeoman Capital Management

A. Value proposition & fees

- Yeoman said that their long term track record speaks for itself

- They said that they have a coherent and understandable investment process that they work at under boom, bust or flat conditions

- Yeoman said that the principles are robust and can take knocks

- They also said that they have people who will get it done and the owners invest their own money in the funds on the same terms as clients

B. Investment strategy

- Value

- Long-only

- Small cap equities in Asia

- A time horizon of medium to a long term of 5 years or longer

- 21 years of track record investing in Asia ex-Japan small cap equities

- 8 years of track record investing in Asian ex-Japan small cap equities

C. Track records

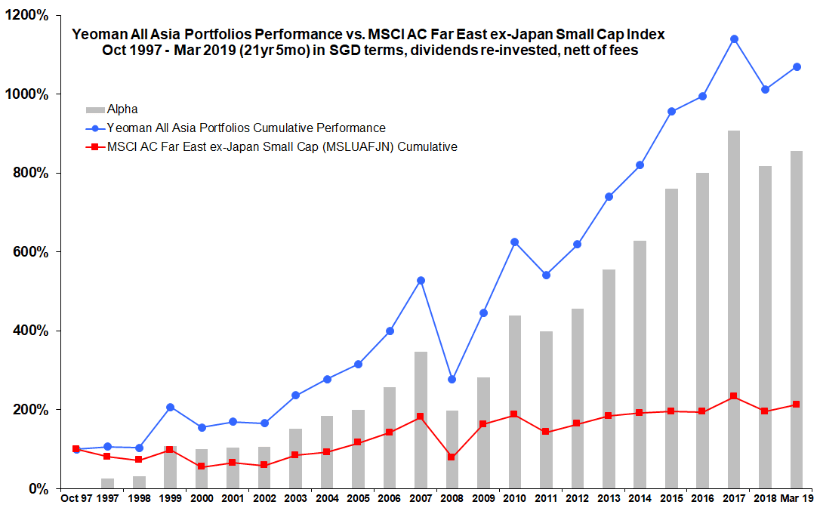

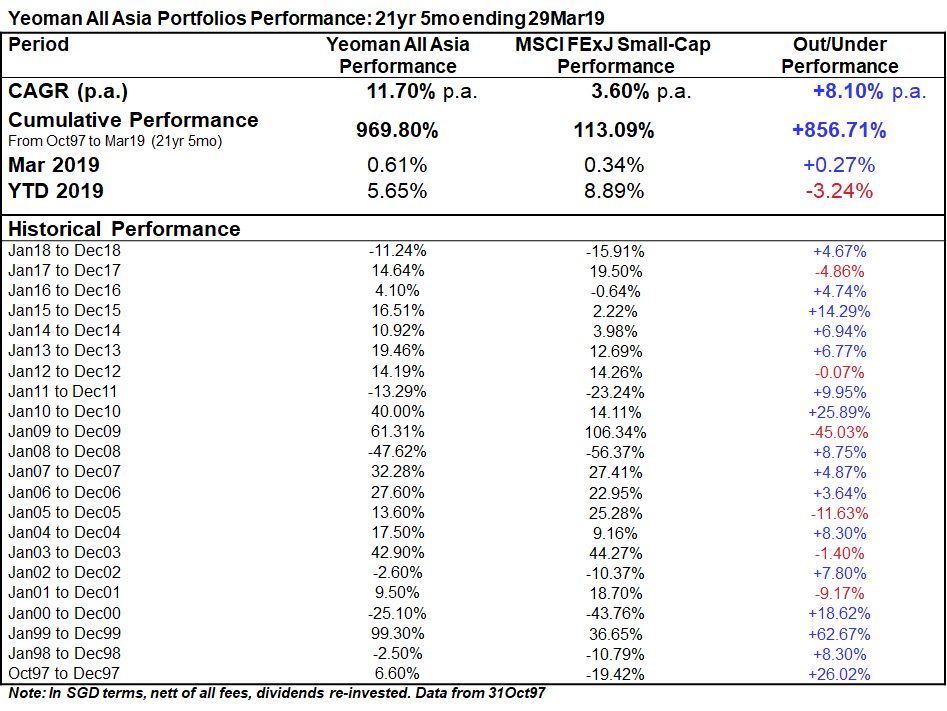

- In the 21 years 5 months ending Mar 2019, the funds under management of Yeoman yielded an absolute cumulative return of +969.80% or a CAGR of +11.70% p.a. nett of all fees (in SGD terms with dividends reinvested).

Yeoman all Asia portfolio is benchmarked against the MSCI AC Far Easy ex-Japan Small Cap. This return presented is nett of fees.

The above shows their track records since October 1997 which was about 21 years and 5 months ago. Their return displayed above is as the graph said, nett of all fees with dividends re-invested.

3. Inclusif Value Fund

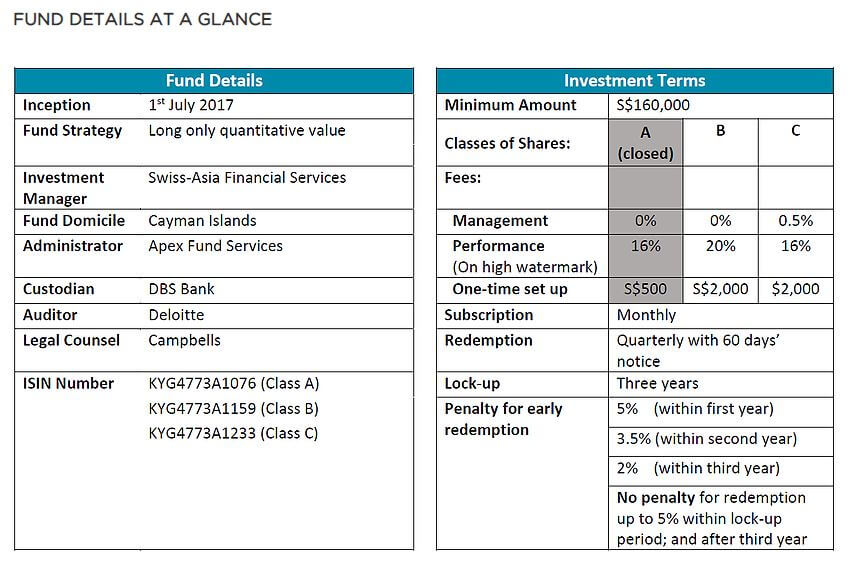

A. Value proposition & fees

- Zero management fees

- 16% performance fees for class A and C

- Lock up of 3 years instead of 5 years

B. Investment strategy

- They focus on long term returns from Asia Pacific Equities

C. Track records

- Inclusif class A shares started trading in June 2017 and as of April 2019, it is up by $3.13, which is a 3.13% increase in absolute NAV return

- Class B and C shares are both down from their starting NAV per share date on January and February 2018 respectively

4. Heritage Value Fund

A. Value proposition & fees

- Zero management fees

- Pay only for performance

- Perfect alignment with the investor’s interest

- 1-year lock-in

B. Investment strategy

- Value-oriented and research-driven

- Investing in publicly-listed companies that are trading at a significant discount to its underlying value in the midst of a down cycle

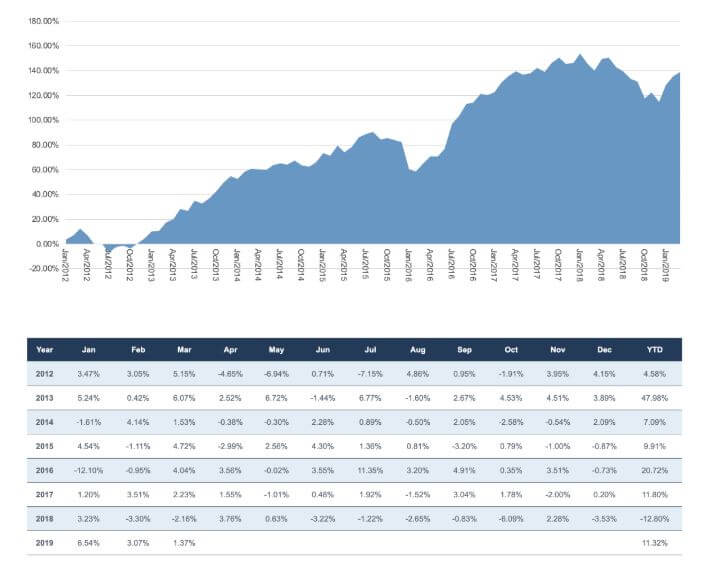

C. Track records

- Did put their CAGR since inception under the fund performance page

- Since inception, their returns are mostly positive except for in 2018

Value Investing Funds Outside of Singapore

1. Value Partners Group

A. Value proposition & fees

- One of Asia’s leading asset managers with assets under management of US$18.3 billion

- The first asset management firm listed on The Hong Kong Stock Exchange in 2007

- 200+ awards and prizes

- Value investing focused

- Investment team consisting of 70 seasoned professionals conducting 6,500 in-person due diligence meetings every year

B. Investment strategy

- A bottom-up approach to stock selection

- Based on their value investing discipline and focuses on intensive fundamental research

- 3 “R” principles: Invest in the Right Business that is run by the Right People and is at the Right Price

- Uses seven core skills in investing: organization, research, decision-making, deal-structuring, execution, maintenance and exit

- Manage risks through developing a thorough understanding of the underlying business, and looking for a high margin of safety

- Willing to be contrarian and challenge common assumptions in order to add value

C. Track records

- They have 13.9% annualized return and 2,735.50% cumulative return since launch in 1993 for Value Partners Classic Fund (A Units)

2. Dhandho Funds

A. Value proposition & fees

- Monish Pabrai

- 0% management fees, 25% performance fee above a 6% hurdle rate with high watermark

- Only bring products to market that is considered world-class

B. Investment strategy

- Value investing

- Concentrated portfolio focusing on companies with a wide moat

- Infrequent bets, only bet when odds are overwhelmingly in favor

- Advocates investing in distressed companies’ stocks that belong to distressed industries

C. Track records

- I cannot find the data on his website but based on Investopedia: “Using principles and strategies he learned from Warren Buffett, Pabrai founded Pabrai Investment Funds in 1999. His long-only equity fund has returned a cumulative 517% net for investors versus 43% for the S&P 500 Index since the fund’s inception in 2000. Outperforming the S&P 500 by 1103% from its inception through 2013, Pabrai quickly became one of the most recognized value investors in the world.”

Legal Disclaimer:

Re-ThinkWealth is a personal value investing & options selling blog. By using this Site, you specifically agree that all the information provided is for general information purposes only and is not intended to be personalized investment or financial advice.

Important: Please read our full disclaimer.

Chris Lee Susanto

Founder of the value investing blog Re-ThinkWealth.com (if you type “value investing blog” in Google, his blog is likely the first one). Being a full-time investor himself, Chris knows that he did not beat the S&P 500 return so far (as of the time of this writing) by listening to stock tips. So, when he teaches, he also doesn’t believe in giving stock tips as it is not sustainable for you in the long run. He will teach you how to make your own intelligent decisions with his 4M1S framework. Feel free to also join his free investment telegram channel here.

Read also now:

Finding True Wealth: Achieving Peace of Mind and Balance in Life

Tony Robbins says that the quality of your life is directly proportional to the amount of uncertainty you can comfortably live with. The key is …

Mastering Risk vs. Return in Investing | Re-ThinkWealth

Risk and return are two of the most important concepts in investing. The relationship between these two factors is crucial to understanding […]

Here are the key principles of value investing | Re-ThinkWealth

The first value investing principle focuses on a company’s intrinsic value. This means looking beyond its market price and considering its […]

Understanding the Margin of Safety in Value Investing

One of the key concepts of value investing is the margin of safety, which is used to potentially reduce the risk of loss in investing in case of…

The Warren Buffett Approach to Value Investing

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

8 Tips on Life and Investment from Charlie Munger

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Definition and Important Good Characteristics of Value Stocks

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Ultimate List of Investing Resources in Singapore (Updated 2022)

Being an avid follower of many investments and finance blogs/websites/resources in Singapore, I thought, why not create an article sharing the…

Here Are 3 Powerful Lessons Investors Can Adopt from Roger Federer

“There is no way around the hard work. Embrace it.” – Roger Federer. In investment, it is important to continue “turning the stones” or keep finding […]

What is Truth Social, Mr. Trump’s Social Media Company?

Truth Social was launched in February 2022. More than one year after Donald Trump was banned from most social media platforms.

The Three US Stocks That Big Funds Are Buying: Booking, Alphabet & Microsoft

The three US stocks that the big fund managers are buying includes Booking Holdings Inc, Alphabet Inc and Microsoft Corp.

Rebranding of VIM logo to communicate our Values better

VIM/Value Investing Mentorship is an investment education […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …

Finding True Wealth: Achieving Peace of Mind and Balance in Life

Tony Robbins says that the quality of your life is directly proportional to the amount of uncertainty you can comfortably live with. The key is …

Mastering Risk vs. Return in Investing | Re-ThinkWealth

Risk and return are two of the most important concepts in investing. The relationship between these two factors is crucial to understanding […]

Here are the key principles of value investing | Re-ThinkWealth

The first value investing principle focuses on a company’s intrinsic value. This means looking beyond its market price and considering its […]

Understanding the Margin of Safety in Value Investing

One of the key concepts of value investing is the margin of safety, which is used to potentially reduce the risk of loss in investing in case of…