Here Are 4 Reasons Why Intel Stock Plunged 16% Last Friday

Last Friday on 24 July 2020, Intel closed 16.24% down.

Although I do not own any Intel stock, I was curious why it fell after releasing their Q2 2020 results.

Just a while ago, I saw the news that after 15 years of partnership, Apple decided to break up with Intel and stop using its chips for Macs.

Here are four reasons why I think Intel fell by more than 16%:

1. Delay of Their 7 Nanometer Chips by About Six Months

Their rival AMD (Advanced Micro Devices) has already started selling their 7 nm chips.

This means that technologically, Intel is lagging behind AMD.

In the fast-paced technological environment, this delay is big news. After all, Intel’s competitive advantage will depend a lot on its technological advances.

See also: Our free investing telegram channel. We post daily.

2. Expects Total Revenue in 3rd Quarter To Drop

Intel is a huge company.

One downside to being a huge company is that it is hard to maintain a high growth rate.

For Intel, they expect total revenues in the 3rd quarter of 2020 to reduce 5.16% year on year to $18.2 billion.

3. Gross Margin Dropped From 59.8% to 53.3%

Intel gross margin was 59.8% in 2Q 2019, now it has dropped to 53.3%. That is a sharp drop.

A drop in gross margin can be a sign of a drop in terms of its pricing power and potential competitive advantage.

Definitely not a good sign if it persists.

Also read: “Patience Produce Uncommon Profits” – Why Patience in Investing is Vital.

4. Exposure to China

Intel has exposure to China.

Recently US-China tensions are on the rise again. And that is not good news to add to Intel’s recent woes.

China is in fact Intel’s largest market. In fiscal 2019, they generated 28% of its revenue or about $20 billion from China.

Intel’s largest facilities are also located in Chengdu and Dalian.

In Conclusion

I think that Intel might be losing its long-term competitiveness in the market. In their industry, technological advantages are also an important source of competitive advantage. Being big and having economies of scale is no longer enough.

As to whether the company is currently undervalued or not, we will need to do our own valuation assumptions on that and decide.

See also: My 5 Key Takeaway From Temasek Portfolio Value in 2020.

Disclaimer:

The information provided is for educational and general information purposes only and is not intended to be personalized investment or financial advice. We make no promises as to the accuracy or usefulness of the information we present.

Important: Please read our full disclaimer.

Chris Lee Susanto

Founder of the value investing blog Re-ThinkWealth.com (if you type “value investing blog” in Google, his blog is likely the first one). Being a full-time investor himself, Chris knows that he did not beat the S&P 500 return so far (as of the time of this writing) by listening to stock tips. So, when he teaches, he also doesn’t believe in giving stock tips as it is not sustainable for you in the long run. He will teach you how to make your own intelligent decisions with his 4M1S framework. Feel free to also join his free investment telegram channel here.

Last Friday on 24 July 2020, Intel closed 16.24% down.

Although I do not own any Intel stock, I was curious why it fell after releasing their Q2 2020 results.

Just a while ago, I saw the news that after 15 years of partnership, Apple decided to break up with Intel and stop using its chips for Macs.

Here are four reasons why I think Intel fell by more than 16%:

1. Delay of Their 7 Nanometer Chips by About Six Months

Their rival AMD (Advanced Micro Devices) has already started selling their 7 nm chips.

This means that technologically, Intel is lagging behind AMD.

In the fast-paced technological environment, this delay is big news. After all, Intel’s competitive advantage will depend a lot on its technological advances.

See also: Our free investing telegram channel. We post daily.

2. Expects Total Revenue in 3rd Quarter To Drop

Intel is a huge company.

One downside to being a huge company is that it is hard to maintain a high growth rate.

For Intel, they expect total revenues in the 3rd quarter of 2020 to reduce 5.16% year on year to $18.2 billion.

3. Gross Margin Dropped From 59.8% to 53.3%

Intel gross margin was 59.8% in 2Q 2019, now it has dropped to 53.3%. That is a sharp drop.

A drop in gross margin can be a sign of a drop in terms of its pricing power and potential competitive advantage.

Definitely not a good sign if it persists.

Also read: “Patience Produce Uncommon Profits” – Why Patience in Investing is Vital.

4. Exposure to China

Intel has exposure to China.

Recently US-China tensions are on the rise again. And that is not good news to add to Intel’s recent woes.

China is in fact Intel’s largest market. In fiscal 2019, they generated 28% of its revenue or about $20 billion from China.

Intel’s largest facilities are also located in Chengdu and Dalian.

In Conclusion

I think that Intel might be losing its long-term competitiveness in the market. In their industry, technological advantages are also an important source of competitive advantage. Being big and having economies of scale is no longer enough.

As to whether the company is currently undervalued or not, we will need to do our own valuation assumptions on that and decide.

See also: My 5 Key Takeaway From Temasek Portfolio Value in 2020.

Disclaimer:

The information provided is for educational and general information purposes only and is not intended to be personalized investment or financial advice. We make no promises as to the accuracy or usefulness of the information we present.

Important: Please read our full disclaimer.

Especially For Ambitious Professionals and Business Owners

- Our Telegram Channel – If you’d like to hear from us daily on stocks, business, economy, and value investing knowledge, please join our free telegram channel here.

- Our Value Investing Mentorship Program – We specialize in coaching (1-on-1) ambitious professionals and business owners looking to learn how to invest in stocks safely and sustainably. Learn more about mentorship with Chris here.

Read also now:

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

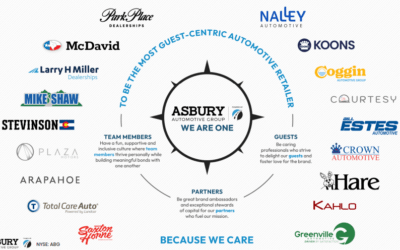

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …