Personal Investment Reflection

Last day of 2017 – a review of my investment journey so far

Chris From RWOA.io, Re-ThinkWealth Content Expert

31 December 2017

Last day of 2017 – a review of my investment journey so far – Time to be cautious?

This year, the stock market rally would have given many investors with a good profit – the Dow (top 30 company in the united states stock market) up 25%, S&P 500 (top 500 company in the united states stock market) up 19% and Nasdaq are up 28% this year.

And I think it is maybe time to be cautious.

Or I should say, cautiously optimistic?

It is commonly known that Warren Buffett says that being greedy when others are fearful and being fearful when others are greedy is one of the ‘secrets’ to a successful investing.

My investment journey so far

I like stock investing. It brings me happiness and it is my passion.

The whole purpose of creating this blog is simply to write down my thoughts so that I have a place to reflect upon it over time.

So that is also what I am going to do today.

I am attempting to review my investment journey in terms of both my relative and absolute performance of my investment results.

For relative performance, I am comparing it with the general stock market return in the top 500 companies in the united states using S&P 500 – SPY ETF.

For absolute performance, it is simply comparing the total money I put inside my portfolio (total cost) and the current net asset value (cost + profit/loss).

My relative investment performance

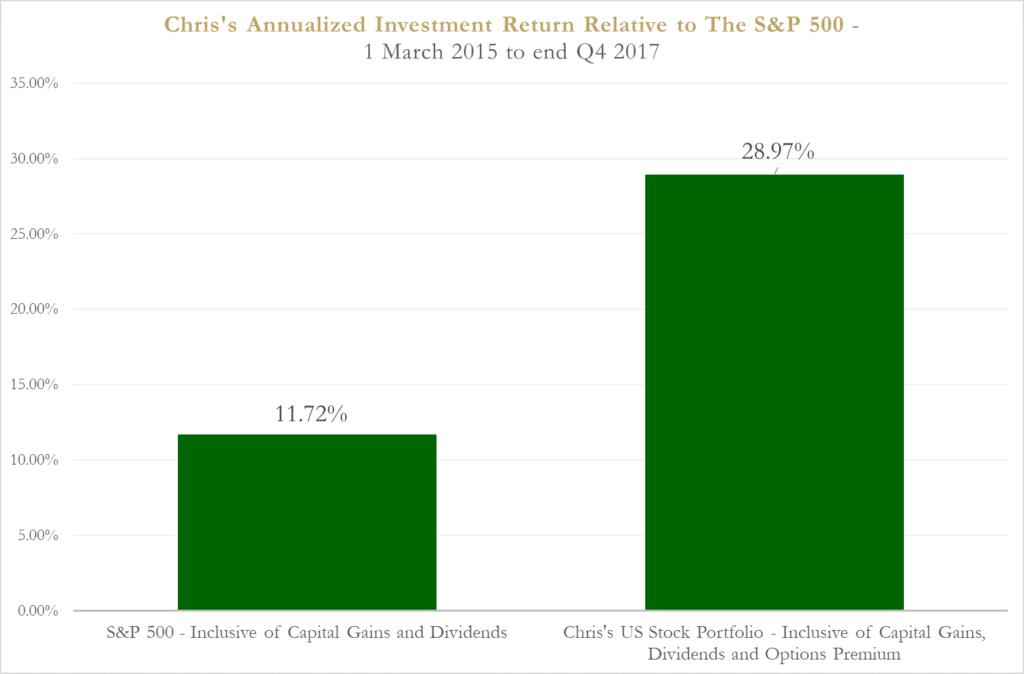

The above image shows the investment return performance – if you have put your money in S&P 500 and my united states stock portfolio – on 1 March 2015 and takes it out end Q4 2017.

25 February 2015 was the first day that I put in money in my US brokerage account. The start of the tracking date of my relative annualized investment return is seven days after I first put money in my US stock portfolio brokerage account – 1 March 2017. This is for ease of tracking as the S&P 500 total return tracking date starts at 1 March 2017 – and do not have 25 February 2017.

Subsequently, the additional deposits date – an important factor in calculating the annualized investment return – are considered in counting the XIRR.

The S&P 500 total return which is inclusive of capital gains and dividends is used as a benchmark to compare my results.

The reason why I did not calculate the strait times index return using the STI ETF as a proxy is that – even though initially I did – that the stocks I bought in the US stock portfolio are US stocks. Hence, the nature of the companies and the return would not be comparable.

Hence, I decided to compare my US stock portfolio return with the S&P 500 return – inclusive of capital gains and dividends.

My absolute investment performance

The start of the tracking date for my absolute return is the end of Q1 2015 – which is 31 March 2015 – for ease of tracking every quarter.

Absolute return simply means looking at the total capital invested in my US stock portfolio and comparing it with the current net asset value of the portfolio and looking at the return/loss comparing those two together.

Focusing on absolute return means that I need to protect capital first on the downside and still make money on the upside.

Capital preservation is key.

In conclusion

I am glad that regarding my absolute investment return, my maximum downside is 15.50% in Q3 2015 and right now, it is up about 50% in Q4 2017.

This shows that in terms of the risk to reward ratio of my investment style and in terms of the volatility of my investment, it has been a good ratio and style so far – because the downside is not too much considering the upside.

So now that I am analyzing my investment performance so far, we should also look at the investment selection process that resulted in my investment performance. Make sense, right?

So, the reason for that must have been because of the company that I picked and the price that I bought their stocks – an important factor.

Another important factor is also the general rise in the stock market in general. A rising tide lifts all boats. But we will only know who is swimming naked when the tide runs out.

So, it is important to be ever disciplined in only buying companies at an undervalued price and selling it when it is overvalued – because holding an overvalued company is still considered speculating.

So on that note, I wish all of you a happy new year 2018 and may the market ever be in our favour yes 😉

Disclaimer: The information provided is for general information purposes only and is not intended to be a personalized investment or financial advice.

Important: Please read our full disclaimer.

Thank you for your time reading! 🙂

If you liked this article, please share it | I write for my readers, you. It would mean a lot to me if others read this as well.

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …