Value investing

Here’s The Value Investing Strategy Warren Buffett Uses In Bear Market

25 May 2022

Value Investing in Bear Market

In this article, I will be sharing the value investing strategy and philosophies that Warren Buffett uses in the bear market.

The information that I will be sharing is curated from many articles and information that I read around.

First and foremost, bear market is a part of life as an investor.

A bear market is a period of falling stock prices of more than 20% from its peak.

During this time, there is usually more fear than greed in the stock market. There are a lot of uncertainties.

In the stock market, like life itself, it contains ups and downs.

So we should not panic.

In fact, we should think long-term.

Let me share further.

Are We In A Bear Market?

Wall Street has recently suffered the longest losing streak since the Great Depression.

The Dow is on its longest weekly losing streak since almost 100 years ago, since 1923.

The Nasdaq has already been in a bear market since March, and the S&P 500 has recently reached the bear market territory.

In these volatile times, what should we do as an investor?

I think it will be wise to pay heed to advise from Warren Buffett.

Value Investing Philosophies in Bear Market

In 2016, during a period of market volatility, Warren Buffett shared, “I would tell [investors], don’t watch the market closely.”

Warren shared that investors who buy good companies over time will see the results 10, 20, and 30 years down the road.

If we buy and sell stocks, we are likely not to have a very good result.

“The money is made in investing by owning good companies for long periods of time. That’s what people should do with stocks.” – Warren Buffett

The legendary investor Jack Bogle also said that our emotions will defeat us totally if we try to sell our holdings to avoid losses and get back in afterward.

“Don’t let these changes in the market, even the big ones [like the financial crisis] … change your mind and never, never, never be in or out of the market. Always be in at a certain level.” – Jack Bogle

Walking away, and not watching the market closely during a bear market is one of the skills of a value investor.

Being a part business owner, not a stock trader, in the grand scheme of 30 or 40 years of investing career, the bear market today could end up being just a blip in our investing journey or a non-event.

In a bear market, or any market, when there is nothing to do, simply don’t do anything, or just walk away.

One of the worst things we can do is to react emotionally and shrink our time horizon to days or weeks.

Because when stock prices fall, we feel that they will fall forever and we should cut loss and sell.

But stocks, historically speaking, has been proven to recover over time.

And selling too early might prevent us from participating in the recovery phase, whenever that may be.

I saw a quote somewhere that says “market don’t settle down, it settles up.”

Having liquid cash is key to use during a bear market, so we will not sell our long-term investments during a bear market.

How Long Will A Bear Market Last?

Historically, most bear markets do not last more than two years.

But if we follow Warren Buffett’s teaching, I think he will say it is a fool’s errand to try to predict how the market will move.

Instead, we should focus on paying for the stock at a price that makes our money’s worth.

Looking at the reason for the current bear market, it’s pretty similar to the bear market in the late 1980s when the Fed raise interest rates to fight inflation. It lasted 622 days, ending in August 1982.

Currently, our Fed Chairman, Jerome Powell also made a similar commitment to continue raising interest rates until inflation subsides.

A Catalyst for A Recovery From Bear Market?

Inflation will not go up forever and interest rates will also not go up forever.

In my view, if inflation eases downward this year, the Fed will not likely keep on raising interest rates.

While currently, Russia is keen to restart peace talks, Ukraine is not – as Ukraine is currently not keen to cede any territories to Moscow.

Currently, the end of war is nowhere in sight. But any positive development may be a potential catalyst for a recovery from the current bear market.

But again, it is hard to predict the stock market movement, and the best thing we can do is focus on the long-term and invest at a price where we think the business should be worth much more.

Ultimately, The Warren Buffett’s Value Investing Philosophy That We Can Count on In A Bear Market is…

“This is the cornerstone of our investment philosophy: Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results.” – Warren Buffett

Ultimately, a bear market will likely not last forever.

And what we need to focus on is investing in a company that we understand a lot about, at a price given a conservative estimate of its future value, there is a high probability of us making money.

Because ultimately, behind every stock, is a business.

And bear market offers value investors the opportunity to acquire shares of these businesses that we believe to have a good future ahead of them, at a discounted price.

Because historically speaking, the best days in the stock market are usually preceded by the worst ones.

So let us all have the right perspective in a bear market, and do not react emotionally, but respond wisely.

Disclaimer:

The information provided is for educational and general information purposes only and is not intended to be personalized investment or financial advice. We make no promises as to the accuracy or usefulness of the information we present.

Important: Please read our full disclaimer.

Benefited from the content?

I will be very thankful if you can share it around on your social media or with your friends ?

Chris Lee Susanto

Co-Founder of Evergrow Fund, Founder of Re-ThinkWealth.com, and Founder of Value Investing Mentorship Club®.

Chris started investing in stocks early at age 21 and is a big proponent of business-like stock investing – a mixture of both value and growth investing. He invests in companies where there is value to be found (as long as it is still within his circle of competence), be it a turnaround, depressed, value, or quality growth company (compounders). He either buys the stock outright or he profits through selling put or selling call options – or buying call options (buying and selling options are especially dangerous for those who do not know how to properly execute them).

Some of the places where Chris has been invited to speak or has added value as a mentor or writer include Singapore Polytechnic, SMU Institute of Innovation and Entrepreneurship (IIE), Seedly TV, Dollars and Sense, The New Savvy, Value Walk Blog, Investment Moats, NUS Tembusu College, NUS Investment Society, CGS-CIMB Singapore, Singapore Financial Conference by NTU IIC, The Financial Coconut Podcast, Money FM 89.3 and Internationally in Myanmar.

He is also a practitioner of Transcendental Meditation and Mindfulness practice. He also advocates regular exercise, enough sleep, and nutritious food as part of our lifestyle as an investor so that we can see things with a clearer lens and not be “caught” due to ignorance.

To find out more about VIM, click here.

Don’t Leave First, Read Also:

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

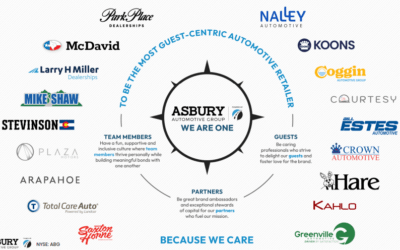

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …