Investing

What I Learnt From Adam Smith About Investment and Money

Chris Susanto

18 July 2020

Who is Adam Smith?

Adam Smith (1723-1790) was a philosopher and economist who was best known for authoring the book An Inquiry into the Nature and Causes of the Wealth of Nations. Wealth of Nations also happens to be one of Warren Buffett’s favourite books.

See also: Our free investing telegram channel. We post daily.

What I Learnt From Adam Smith About Investment and Money

1. Professional investors are deemed to be smarter because they can churn out ratios at the touch of a button compared to the small investor. They are in fact, not smarter, they merely have more information

It is true that the pros have more resources at hand to subscribe to Bloomberg Terminal for example which cost a bomb. And they are deemed to be smarter.

But the truth is having more resources and information may not always result in better investment performance. Because investment performance is also a lot about managing our emotions.

2. To be a good investor, you have to be a good brain picker and brain pickers are usually good for a dinner conversation

Hence the saying too, it is not just what you know, but who you know.

This does not mean that we should ask for stock tips.

I think that what Adam might be saying here is that we should leverage on people’s views on some stocks he or she might be looking at.

It is ultimately left to our judgment, analysis, and valuation on whether the stock is worth investing or not.

3. The safest way to preserve capital is to double it

I believe in this insight of him. It is indeed the safest way because if we manage to double our money, we can withstand more draw-down and still preserve our capital.

4. The stock does not know that you own it

This is one of my favorite ones. Recently I talked to a friend, an ex MD of UBS. Even a man of his experience would agree with me that people (including myself) anchor the stock to the price we bought it at. But hey, the stock does not even know that we own it. And at what price. But humans are often very emotional about stocks and anchor them to the price we bought it at.

In the end, what matters is the value of the business, not the daily stock price movement. So in a sense, the price is meaningless, our value of it – and whether we are right or wrong is.

5. 80% of the market game is psychology

I agree. That is why I named my blog re-thinkwealth. It is to remind us to rethink our assumptions and logic. And to remind me as well that ultimately the name of the game is having good emotional control as well as a rational mind.

6. If you do not know who you are, the market is a terribly expensive place to find out

I agree. The stock market often rattles people because [1] they follow people blindly and do not understand what they are doing [2] they forgot that investing in the stock market is a combination of good emotional control as well as having a rational mind.

Disclaimer:

The information provided is for general information purposes only and is not intended to be a personalized investment or financial advice.

Important: Please read our full disclaimer.

Chris Lee Susanto

Founder of the value investing blog Re-ThinkWealth.com (if you type “value investing blog” in Google, his blog is likely the first one). Being a full-time investor himself, Chris knows that he did not beat the S&P 500 return so far (as of the time of this writing) by listening to stock tips. So, when he teaches, he also doesn’t believe in giving stock tips as it is not sustainable for you in the long run. He will teach you how to make your own intelligent decisions with his 4M1S framework. Feel free to also join his free investment telegram channel here.

Read also now:

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

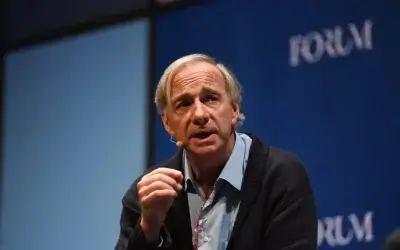

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

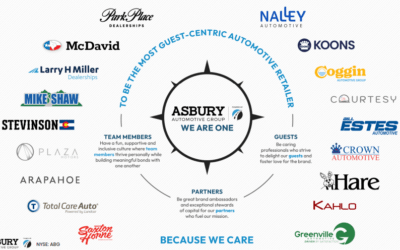

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …

Finding True Wealth: Achieving Peace of Mind and Balance in Life

Tony Robbins says that the quality of your life is directly proportional to the amount of uncertainty you can comfortably live with. The key is …

Mastering Risk vs. Return in Investing | Re-ThinkWealth

Risk and return are two of the most important concepts in investing. The relationship between these two factors is crucial to understanding […]

Here are the key principles of value investing | Re-ThinkWealth

The first value investing principle focuses on a company’s intrinsic value. This means looking beyond its market price and considering its […]

Understanding the Margin of Safety in Value Investing

One of the key concepts of value investing is the margin of safety, which is used to potentially reduce the risk of loss in investing in case of…

The Warren Buffett Approach to Value Investing

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

8 Tips on Life and Investment from Charlie Munger

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Definition and Important Good Characteristics of Value Stocks

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Ultimate List of Investing Resources in Singapore (Updated 2022)

Being an avid follower of many investments and finance blogs/websites/resources in Singapore, I thought, why not create an article sharing the…

Here Are 3 Powerful Lessons Investors Can Adopt from Roger Federer

“There is no way around the hard work. Embrace it.” – Roger Federer. In investment, it is important to continue “turning the stones” or keep finding […]