Stock analysis/investing

What is Sustainable Stock Investing and Does It Work?

17 September 2021

What is Sustainable Stock Investing?

ESG/ sustainable investing is a form of investing that is generally viewed as socially responsible. It should focus on the company’s financial return together with the impact of the company’s action on the environment and stakeholders.

ESG stands for Environmental, Social, and Governance. Which are the common three criteria to evaluate a company’s sustainability.

Environmental can means how a company’s action is related to say, Carbon footprint, renewable energy usage, or Greenhouse gas.

Social can means how a company’s action is related to say, how a company treats their employees, employees’ safety policies, and employee diversity and inclusion in hiring, promotions, and compensations.

Governance can mean how a company’s action is related to say, the diversity of the board and management team, separation of the Chairman and CEO roles, and also policies to enforce ethical business practices.

Companies that commit themselves to ESG usually will report their ESG initiatives plus the progress against their goals. It can be in a form of sustainability reports established by the Global Reporting Initiative.

Does Sustainable Stock Investing Works?

In September 2021, Prof Aswath Damodaran, a widely respected New York University finance professor said that ESG investing is “not just a mistake that will cost companies and investors money while making the world worse off, but that it create more harm than good for society.”

In Morningstar, their view is that Prof Damodaran raises some good points but he’s mostly wrong on his key assumption.

Morningstar’s view is that good ESG investing attempts to improve equity valuation and account for the risks posed to businesses from climate change and human resource regulations.

While Damodaran’s view is that sustainable investing is that measuring “Goodness” is not easy to measure. And in ESG/sustainable investing, we need to come up with some measures of “goodness” that can be targeted by corporate managers and used by investors.

My view is that investing sustainably is important and it requires us to have a holistic point of view of the ESG factor ultimately for the business longevity and the sustainability of society.

What’s your view?

Warren Buffett View on ESG Investing

Warren Buffett is not a big fan of ESG and he noted that most ESG requests he received came not from shareholders, but from third-party organizations.

In Berkshire, they do not like reporting just for the sake of it. And Buffett thinks ESG reporting falls under this umbrella.

Although Buffett has passed on tobacco investments in the past due to ethical concerns, they are comfortable investing in oil and gas companies.

In short, Warren Buffett does not seem to be a big fan of ESG reporting.

In Conclusion

For me, I am a firm believer in sustainable investing. And in investing with a purpose for the good of society.

But I am aware that that can only be done if the business also prospers and if the business prospers first.

So I think that while companies should not ignore the ESG part for sustainable investing, they have to ensure that they are focusing on ESG because they want the business to last a long time – and grow for a long time.

There is no point to focus on ESG but the business suffers over the long term.

Disclaimer:

The information provided is for educational and general information purposes only and is not intended to be personalized investment or financial advice. We make no promises as to the accuracy or usefulness of the information we present.

Important: Please read our full disclaimer.

Learned something from this article?

Share it 🙂

Chris Lee Susanto

Chris started investing in stocks early at age 21 and is a big proponent of business-like stock investing – a mixture of both value and growth investing. He invests in companies where there is value to be found (as long as it is still within his circle of competence), be it a turnaround, depressed, value, or quality growth company (compounders). He either buys the stock outright or he profits through selling put or selling call options – or buying call options (buying and selling options are especially dangerous for those who do not know how to properly execute it).

Some of the places where Chris has been invited to speak or have added value as a mentor or writer includes Singapore Polytechnic, SMU Institute of Innovation and Entrepreneurship (IIE), Dollars and Sense, The New Savvy, Value Walk Blog, Investment Moats, NUS Tembusu College, NUS Investment Society, CGS-CIMB Singapore, Singapore Financial Conference by NTU IIC, The Financial Coconut Podcast, Money FM 89.3 and Internationally in Myanmar.

He is also a practitioner of Transcendental Meditation and Mindfulness practice. He also advocates regular exercise, enough sleep, and nutritious food as part of our lifestyle as an investor.

As of the time of this writing, Chris is focusing on setting up his MAS Licensed Fund with the goal to beat the market over the long run.

Feel free to join his FREE investment telegram channel here to be one of the first to be updated on his new articles.

Don’t Leave First, Read Also:

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

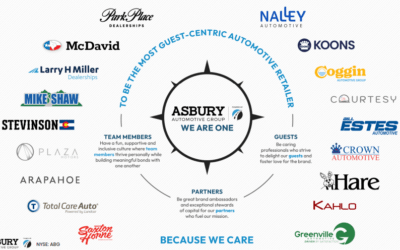

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

Here’s How to Budget with Value Investing Principles

For a lot of people, budgeting their finances feels like a chore. In this article, I will share my thought process on how we view budgeting …

Beyond value investing: Timeless Insights from the Late Charlie Munger

Charlie Munger was not just an investment icon and the partner of Warren Buffett. He was also a master of navigating life’s complexities…

WeWork: Would An Investment in WeWork Have Worked Out?

WeWork looming bankruptcy. But would an investment in WeWork have worked out, ever? In this article, we look into the story and …

A Beginner’s Guide to Value Investing in Singapore

Value investing is an investment strategy that seeks to buy stocks that are trading below their intrinsic value. This means that the stock is …