Reflections

24/3/2017 Was The First Time I Bought GameStop: About Time a Private Equity Firm is Interested in it!

Chris Lee Susanto, Started investing in Singapore and U.S. stock market utilizing value investing & options selling strategies when he was just 21 years old. He is 25 years old this year. In the year 2015 at just the age of 22, he established Re-ThinkWealth.com – a blog where he often shares USA based value investing insights and options strategies. He also guests blog in renowned U.S. fund focused investing websites such as Value Walk and Singapore investing sites such as The New Savvy, Investment Moats and Dollars and Sense. In 2017, he was invited to share his insights on the art of value investing for students from Strategos in NUS Tembusu College and on entrepreneurship and investment for a graduating Diploma in Business cohort at Singapore Polytechnic. In 2018, he was invited to be a mentor in the Youth Innovation Challenge organised by Singapore Management University (SMU) Institute of Innovation & Entrepreneurship. On top of that, he often conducts his own personal closed group sharing session for some of his students (usually free of charge). As of the end of quarter 1 of 2018, he manages a U.S. stocks six-figure portfolio making 18.21% annually (capital gains + dividends + options premiums) (tracked starting from 1 March 2015 on a quarterly basis). He runs the members-only RWOA.io VIM Club, learn more here.

19 June 2018

I wrote about GameStop (NYSE: GME) a total of 7 times in my blog so far:

- 12 May 2017 – GameStop Corp (NYSE: GME)– A Cigar Butt Investing Play

- 16 June 2017 – Options Selling Strategy – Wk 3 June 2017 (GameStop Inc (NYSE: GME)

- 9 November 2017 – Re-examining GameStop as a cigar butt stock investing opportunity

- 22 November 2017 – GameStop Q3 17 Earnings — Glad Going Against The Crowd Was Right

- 14 January 2018 – Is GameStop Doomed? I Visited Their Stores in NY to Find Out

- 29 March 2018 – Here’s My Thoughts on GameStop’s Q417 Earnings Results (Released 28/3/2018)

- 30 March 2018 – Good Result and Yet The Stock Fell 10+% – GameStop’s So Unloved

Purpose of This Article Today

The purpose of me writing down this article today is to reflect on and document the thought process that resulted in me to have first bought GME in March 2017.

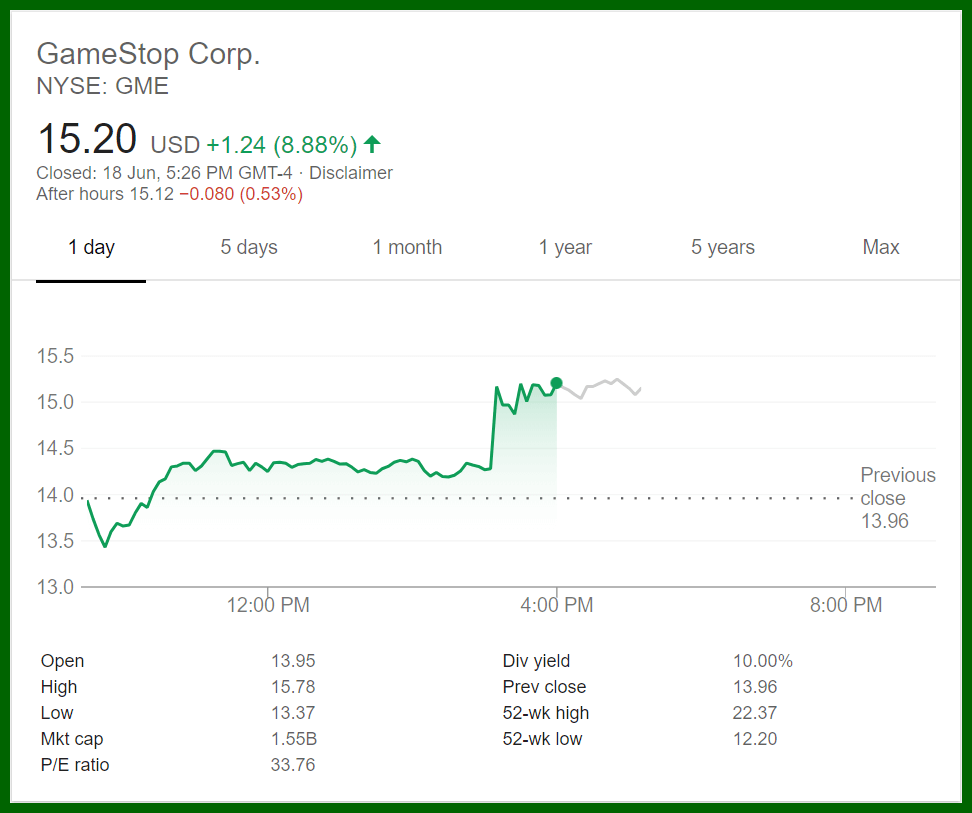

Because the fact is that today, it is reported by Reuters that GME has received buyout interest and is holding talks with private equity firms about a potential transaction. Seems like Sycamore Partners – one of the PE firms that have expressed interest in GME agrees with my conclusion and analysis that GME is mispriced and is undervalued at current prices.

From the analysis, I will also forecast – based on Sycamore’s past behavior, what they might offer for GME and whether GME would accept it or not.

This reflection is important because it is not the first time that a stock of mine has received buyout interest – which is a good thing – so reflecting on the process to reach this outcome is important for me. I first bought Qualcomm in January 2017 and after that, Broadcom made an offer to buy over Qualcomm which ultimately was ended by President Trump executive order.

Coincidentally, I only hold two stocks now in my concentrated U.S. stocks portfolio – Qualcomm and GME – which has both received buyout interests. One was an official offer for Qualcomm, and currently is still an interest – and not a buyout offer yet as you can see from the image above depicted by the two green arrows.

What are the odds of that happening? Bought two stocks I have high-conviction in – which is currently the two largest holdings in my U.S. stocks portfolio made up over 70% of my holdings – and both have buyout interests.

Here are my key takeaways on why I bought and still holding GME:

I first bought GME when it was above $20 because I knew it was cheap relative to its fundamentals which took into account free cash flow generative ability and the over-pessimism the market has in the company. At their current expected free cash flow for 2018 of about $300 M, there is never a time in the last decade that their price went as low as it is today for GME. There is obviously over-pessimism in the market.

Despite the fact that it is in the retail gaming industry which counts a lot on making money via its pre-owned segment of the business and is hit badly by downloadables and microtransactions, I bought it because of the results of the company that does not show that gleam of an outlook like most people says.

Over time, I averaged down on GME because I learned from my past mistakes of not averaging down on MBT and Keppel Corporation that could have allowed me to make more gains when I am convicted in a stock.

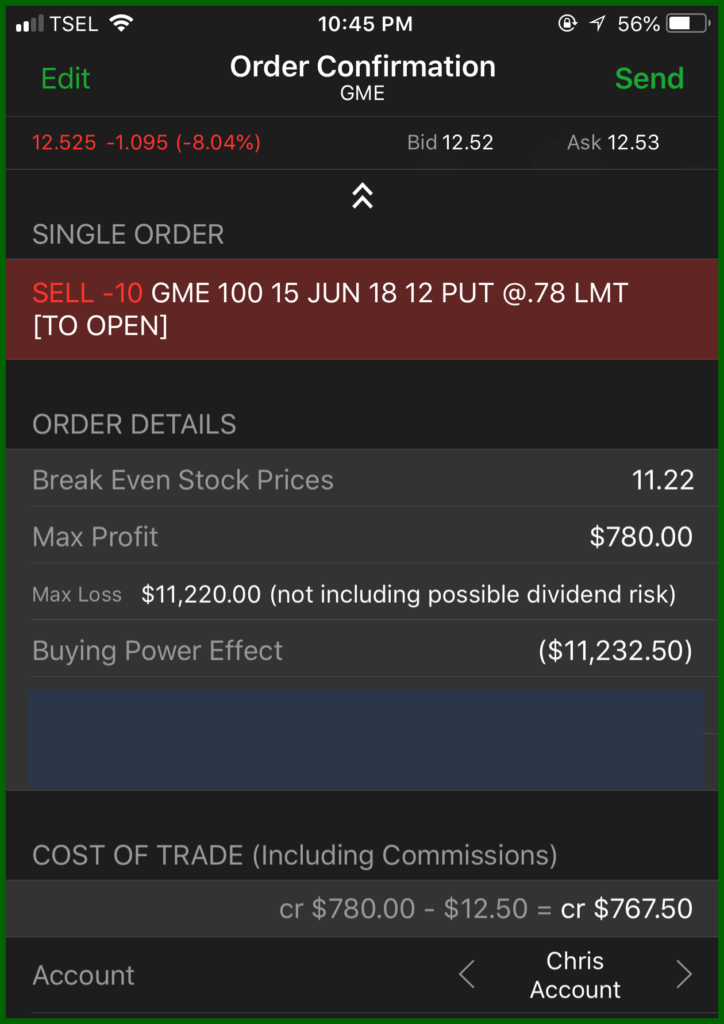

Meanwhile while holding GME, I received good dividends of about 6-7% after tax and options premiums every now and then – through a couple of puts and calls. My average cost taking into account the dividends and options premiums I received should be about $15+.

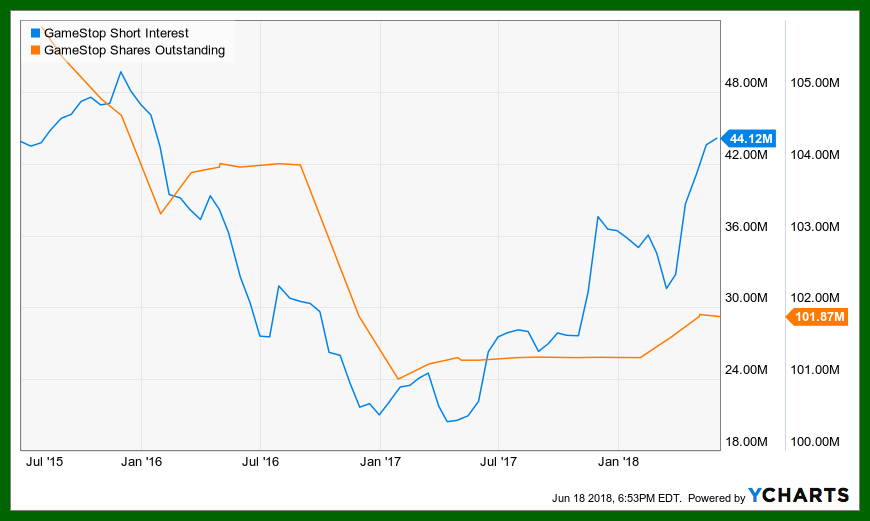

I’ve always thought that investment is not about making money, it is about having the correct investment process – and the results will come – in time. For GME, a company that has 44.12M shares shorted over a total share of 101.87M, a short squeeze is underway with so much negativity in the company.

Many times, I’ve questioned myself if I am subconsciously looking for evidence to support me still holding GME despite it being to be as low as $12.20 in recent times.

A combination of factors like over-pessimism supported by good fundamentals based on my checklists and unprecedented opportunity to get a good CEO from outside to run GME replacing current interim CEO resulted in me sticking to my conviction of holding GME.

Some background about Sycamore Partners based on their website:

- It is a private equity firm specializing in retail and consumer investments

- It has more than $3.5 billion in capital under management

- Their strategy is to partner with management teams to improve the operating profitability and strategic value of their businesses

- Their current investments include Nine West and Coldwater Creek. You can see more here.

Based on a Wall Street Journal article in 2018, Sycamore Partners has been very successful in their investment in the retail sector and they made hundreds of millions of dollars in the struggling retail sector by buying brick-and-mortar chains.

As you can see from the image above, while the public has been running away from making retail deals, Sycamore made bigger bets in the sector. It bought Staples Inc. in September 2017 for $6.8 billion – the highest buyout figure in 2017 according to Dealogic.

Sycamore strategy is often to buy struggling retailers, selling off their most valuable pieces, cutting costs and using the savings to extract dividends. Their first fund, a $1 billion pool raised in 2012, returns 43% after fees as of the end of June 2017 according to fund documents revied by the WSJ.

“Sycamore is the best of the bunch in the retail sector,” said Craig Johnson, president of Customer Growth Partners, a retail research firm.

Here are what Sycamore tells its investors their portfolio companies are worth:

Sycamore main loss is in Nine West Holdings where it has written off their equity stake by nearly 88% to $13 million as of June 30. But their returns from the brands they split off and sold were more than four times as much as its losses from the Nine West write-downs.

Seems like Sycamore is a really good PE firm that is great at finding companies to buy over and unlock the value from them. Of course, this means that they only buy companies in which they find that the current price in the market is too low in order to generate returns for their investors.

In conclusion

I think that obviously, Sycamore is interested in GME because they see value in GME. That means that GME is undervalued and they would like to unlock the value from the company – probably from selling off some of its valuable assets and curring down costs further.

The key factor here is the board of directors decision on whether to accept some of these buyout offers or not. There is a high chance in my opinion that the BOD will accept an offer quite easily since most of them are of a quite an old age – as you can see from the image above – with the executive chairman Daniel already at 70 years old.

I am not expecting a high offer for GME, probably if there is one, it will be in the $18-$20 range – and the BOD would most likely accept it.

Disclaimer: The information provided is for general information purposes only and is not intended to be a personalized investment or financial advice.

Disclosure: I own shares of and is long on Qualcomm (NASDAQ: QCOM) and GameStop (NYSE: GME).

Important: Please read our full disclaimer.

Learn more about the new RWOA.io VIM Membership* (limited slots) by clicking here and if you have any questions, you can schedule a call with me here.

Thank you for your time reading.

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …

Recession Fears and Value Investing: Navigating Uncertainty and Building Long-Term Wealth

In the past year, the world has been grappling with a looming recession and high inflation. There is a question of whether we […]

Conquering the Inner Market: Psychology for Investing Success

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Becoming Antifragile in Stock Investing by Embracing The Volatility

The concept of “Antifragile” is popularized by Nassim Nicholas Taleb in his book that is aptly named “Antifragile”. What is Antifragile? …

Demystifying the S&P 500: A Beginner’s Guide to America’s Stock Market Powerhouse

Have you ever heard of the S&P 500? This mysterious abbreviation often pops up in financial news, leaving many wondering what is it […]

My Reflections and Learnings on My 31st Birthday | Re-ThinkWealth

I just turned 31 recently and usually on my birthdays, it’s always feels like the right time to reflect on my …

Remembering Daniel Kahneman: Author of Thinking, Fast and Slow

The world of behavioral economics and psychology lost a giant with the passing of Daniel Kahneman in March …

Ray Dalio’s Gems: My Key Learnings for Life and Success (Updated Regularly)

Ray Dalio is a global macro investor for more than 50 years, who founded Bridgewater Associates out of …

Asbury Automotive: An Undervalued Gem in The Stock Market?

I have owned shares in Asbury Automotive Group, Inc., for about 18 months. Asbury is essentially a collection of …