Welcome to The Re-ThinkWealth Blog

“The key to investing is not how smart we are or how fast we go. It is to be right more often than we are wrong. Big money is made swinging big for the fat pitches. It is going for the big bet right inside our competence circle. That’s the key to investing.” – Chris Susanto

About Chris Susanto

Chris is the Founder of Re-ThinkWealth.com & VIM (Value Investing Mentorship Club®).

He is also a Board Member at Bansea and an Independent Director of Bansea Fund 2. Bansea is Asia’s oldest angel investment network, founded in 2001.

Chris started investing in stocks early at age 21 and is a big proponent of business-like stock investing – a mixture of value and growth investing.

He invests in listed companies where there is value to be found (as long as it is still within his circle of competence), be it a turnaround, depressed, value, or quality growth company (compounders).

Some of the places where Chris has been invited to speak or have added value as a mentor or writer include Singapore Polytechnic, SMU Institute of Innovation and Entrepreneurship (IIE), Seedly TV, Dollars and Sense, The New Savvy, Value Walk Blog, Investment Moats, NUS Tembusu College, NUS Investment Society, CGS-CIMB Singapore, Singapore Financial Conference by NTU IIC, The Financial Coconut Podcast, Money FM 89.3 and Internationally in Myanmar. He is also a part of the SMU BFI (Business Families Institute) network.

Chris is also a practitioner of Transcendental Meditation.

“Meditation, more than any other factor, has been the reason for what success I’ve had. Meditation leads to openness, to freedom, where a kind of intuition just comes through. You could step back and put things in perspective” – Ray Dalio on Transcendental Meditation, founder of the largest hedge fund in the world with $140 Billion under management.

If you are also on LinkedIn, feel free to connect with Chris on Linkedin here and say hi!

Read Chris’s Latest Blog Post Now:

The Definition and Important Good Characteristics of Value Stocks

Based on the Oxford dictionary, value stocks are shares of a company with solid fundamentals that are priced below those of its peers, based …

The Ultimate List of Investing Resources in Singapore (Updated 2022)

Being an avid follower of many investments and finance blogs/websites/resources in Singapore, I thought, why not create an article sharing the…

Here Are 3 Powerful Lessons Investors Can Adopt from Roger Federer

“There is no way around the hard work. Embrace it.” – Roger Federer. In investment, it is important to continue “turning the stones” or keep finding […]

What is Truth Social, Mr. Trump’s Social Media Company?

Truth Social was launched in February 2022. More than one year after Donald Trump was banned from most social media platforms.

The Three US Stocks That Big Funds Are Buying: Booking, Alphabet & Microsoft

The three US stocks that the big fund managers are buying includes Booking Holdings Inc, Alphabet Inc and Microsoft Corp.

Rebranding of VIM logo to communicate our Values better

VIM/Value Investing Mentorship is an investment education […]

Here’s The Value Investing Strategy Warren Buffett Uses In Bear Market

In this article, I will be sharing the value investing strategy and philoso […]

STI ETF: Historical Returns, Dividends, Investment Prospects in 2022

STI ETF or Straits Times Index is the index of the top 30 companies listed in […]

GoTo IPO: Will I Invest in The New Company of Gojek and Tokopedia?

GoTo IPO date is on 11 April 2022. Analyzing their prospectus, will I invest in […]

Russia-Ukraine War: How to Keep a Level Head And Invest Long Term

In this article, I will be sharing my opinion on how to keep a level head and invest […]

I Recently Got Covid. Here’s How It Affected My Investment Outlook

In this article, I will be sharing my journey on recently having acquired COVID-19 and […]

22.70% vs 15.19%; My Performance vs S&P 500 for Close to 7 Years

In this article, I am going to try to condense what I have reflected on, learned, and applied through […]

3Q 2021 Update to My Carnival Corp Stock Thesis

In June 2021, I wrote that I think Carnival Corp stock is likely going to sail higher in 2021. It took a […]

What is Sustainable Stock Investing and Does It Work?

What is Sustainable Stock Investing? ESG/ sustainable investing is a form of investing that is generally […]

Top 10 Warren Buffett Quotes on Investing | Re-ThinkWealth.com

Is FB a social media company? An advertising company? Or a chat company? Or a VR company? Online […]

Quick Analysis on FB Stock by Re-ThinkWealth.com (August 2021)

Is FB a social media company? An advertising company? Or a chat company? Or a VR company? Online […]

Growth or Value Investing? Why Not Both? – Re-ThinkWealth.com

Both value and growth investing have the same goal: which is to find the biggest opportunity or a gap or […]

Will Carnival Corp Stock Sail Higher in 2021? (June 2021)

“Carnival” based on the Oxford dictionary can also be defined as “a traveling funfair or circus.” The name is apt for a […]

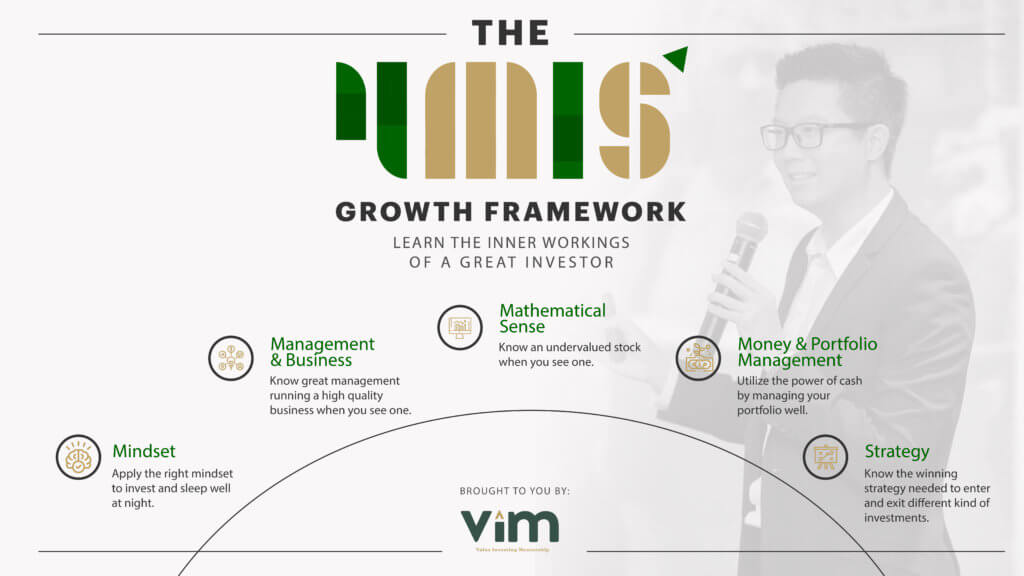

Unique 4M1S Framework

I created the 4M1S framework through my years of experience investing in the stock market since I was 21 – utilizing both stocks and options (buy and sell).

The framework is created mainly through my personal experience of what works and what does not work in the stock market.

More Testimonials on Chris

“Despite having >15yrs stock invest experience, I needed 1:1 guidance to stay focused in order to learn more about value investing. Chris’s newsletters and his personalized training can be of great help to beginners & matured investors.” – Ravi, Quality Manager from Leading US Semiconductor MNC

“Chris’s Exclusive 1:1 Mentorship has changed my life financially for the better. So far I have made over 20% in just 1 stock that I invested in. The profit that I got easily covered multiple times the fees I invested in the club. He is a passionate value investor and it is evident in the work that he put in for his members.” – Jess Liu, Executive Director, DBS Private Banking

“Chris Lee’s maturity beyond years coupled with service mindset drives his ideas to market. Re-Think Wealth is an open, accessible platform for anyone interested to learn and go live in the world of investing within a short period of time. Hard earned lessons from a wise peer mentor. Chris does not hold back to share.” – Liyana Sulaiman, CPO & Co-founder @ Pollen l Community Commerce Builder

“As part of my journey to learn about value investing, I came across Chris’s profile and joined his program to learn about options trading. Chris gave a step by step guidance and answered all my questions to give me the confidence to enter my first trade. His teaching of value investing and options trading is grounded with case studies and live teaching. I would recommend Chris and his VIM program for those looking for that edge.” – Russell N, Real Estate Fund Manager

“Great guy. Mature for his age and Good Insights. Would Recommend that People Subscribe to His Newsletter – useful!” – Kevin Lim, Associate Director – Portfolio, Strategy and Risk Group at Temasek Holdings

“I’ve been very impressed with Chris as someone who sets goals for himself and works hard to realize each of them. In particular, he’s impressed me with his knowledge of the finance world – particularly Value Investing and Options Selling – and I have found his Investing Newsletter to be Very Informative. He’s also a genuinely pleasant and gracious person – and very grounded – someone I enjoy talking with whenever the opportunity arises. I’m excited to see where life is going to take Chris – what opportunities will come his way – I believe his level of initiative is going to take him far.”- Tom Estad, Ex Academic Director, SUTD-SMU Dual Degree Programme at Singapore Management University